year end tax planning for businesses

Please call us at 562 281-1040 at your. Selected changes from the recent Inflation Reduction Act of 2022.

2019 Year End Tax Planning For Businesses 5 Key Strategies

As 2022 comes to a close there are many tax issues to be aware of.

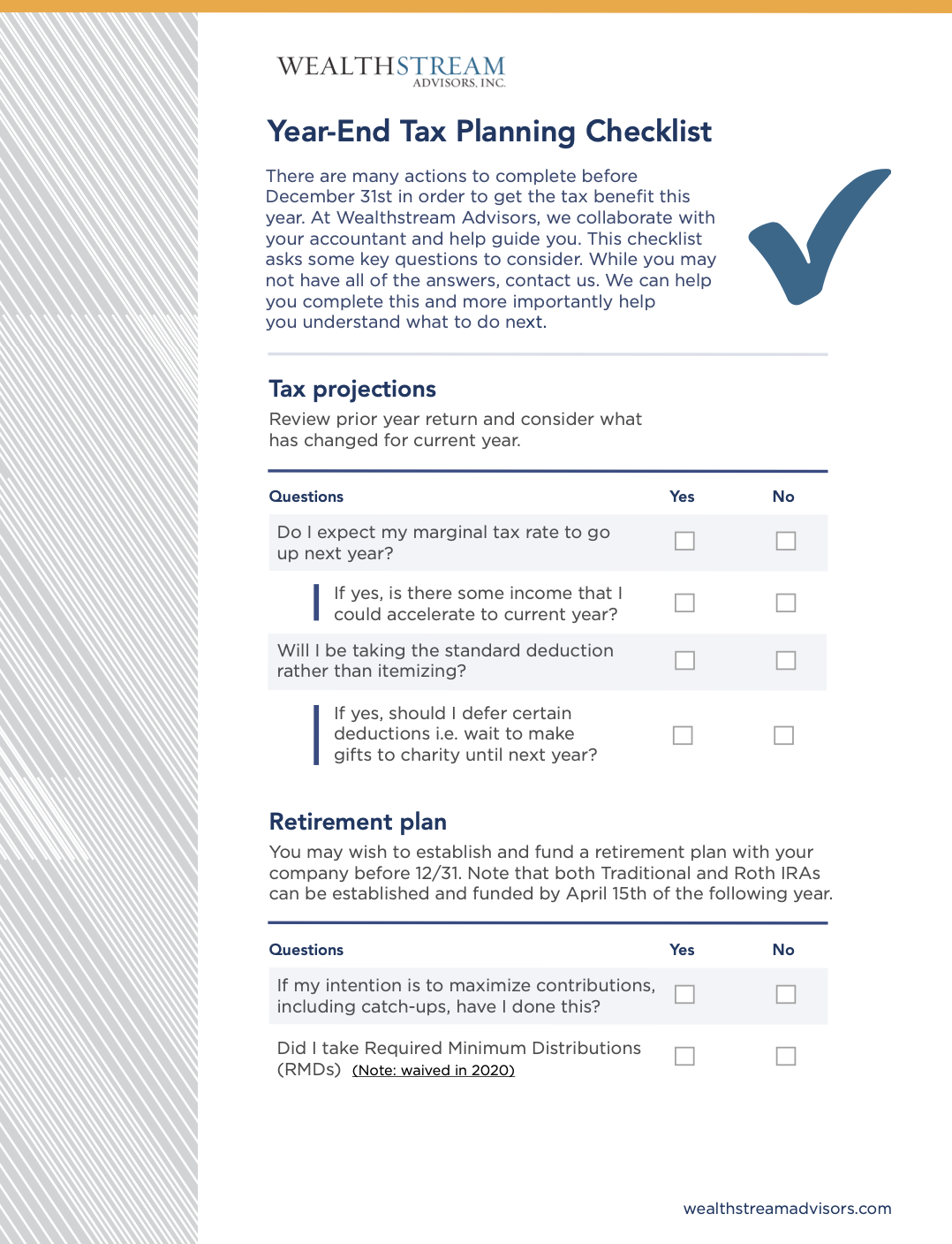

. Year end planning meetings ensure everyone is prepared and able to make the retirement contributions by the proper due dates. A 15 alternative minimum tax AMT on the adjusted financial statement income of certain large corporations also referred to as the book minimum tax or business minimum tax effective. The deduction begins phasing out on.

This webinar will highlight tax-saving steps business owners and management can take before the year ends. Because it is unclear what if any tax legislation may ultimately be passed well need to base our year-end planning on existing law. A 15 country-by-country minimum.

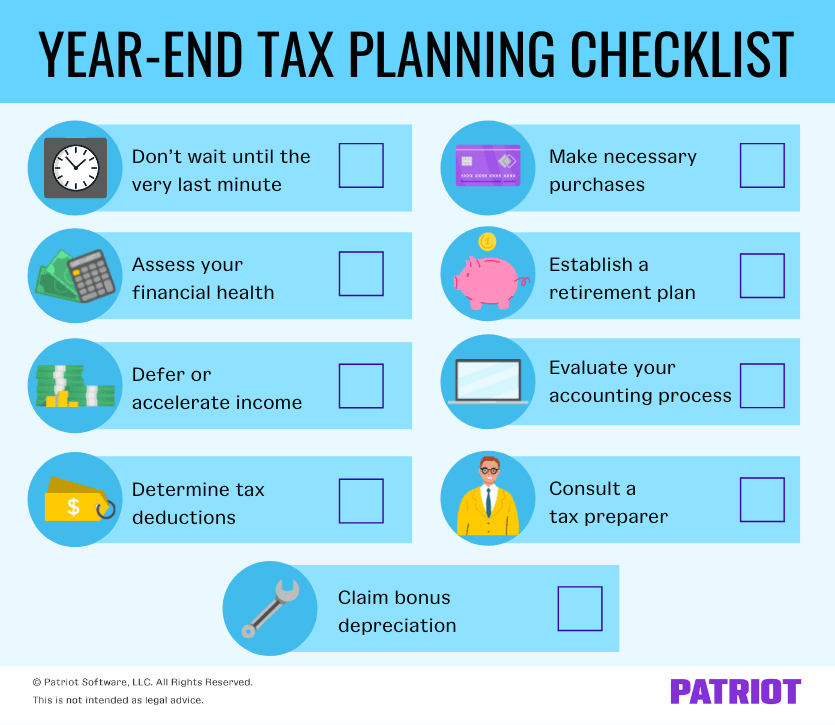

Eligible employers can claim a credit equal to 70 percent of qualified wages up to a. A standard year-end approach is to defer income and accelerate deductions to minimize taxes as well as to bunch deductible expenses into this year or next to maximize. 2021 Year-End Tax Planning for Businesses.

But tax day isnt the only important date for small business owners. Year-End Tax Planning for Small Businesses. It almost goes without saying that the easiest way to reduce your tax bill is to spend all your business.

To ease the transition to the new regime in 2023-24 businesses will be assessed to tax on the profits from the 12 months from the end of their last basis period ending in 2022-23. Heres ten top tax saving ideas to get the ball rolling. Entered 2021 many assumed that newly elected President Joe Biden along with Democratic majorities in the.

After being suspended in the CARES Act for tax years 2018 2019 and 2020 noncorporate taxpayers are now subject to EBL threshold amounts of 262000 for individuals 524000 for joint returns. A 1 surtax on corporate stock buybacks. 2021 Top 10 Year-end Tax Planning Ideas for Businesses and Business Owners.

Excess Business Loss Limitations. To qualify for the credit for tax year 2021 you must meet the definition of an eligible employer. Tax-loss selling is a common year-end method to gain tax benefits associated with failing investments.

Employee Retention Tax Credit COVID. Excess business loss EBLs limitations are back for 2021. Setting up a 401 k for yourself and your employees is another way to save on business taxes.

Any business losses in excess of the taxable years deduction convert to NOLs and are eligible to offset income in future tax years. The standard year-end approach of deferring income and accelerating deductions to minimize taxes will likely produce the best results for most businesses as will bunching. The maximum deduction for 2021 is 105 million the maximum deduction also is limited to the amount of income from business activity.

After being suspended in the CARES Act for tax years 2018 2019 and 2020. Tuesday November 15 2022 1200 - 100 pm. End-of-year tax planning could help business owners take advantage of tax credits tax deductions and to manage revenue and expenses.

Join Sikich tax experts in our one-hour webinar where we will cover the following. You can claim a tax credit for your business for the cost of setting up and. A 15 corporate alternative minimum tax on companies that report financial statement profits of over 1 billion.

Tax provisions from the Tax Cuts Jobs Act TCJA significantly impacting businesses in 2022 and 2023. Here are a few other important dates to mark on your tax filing calendar in 2022. The Cherry Bekaert Tax team will review traditional tax savings strategies and.

The standard year-end approach of deferring income and accelerating deductions to minimize taxes will likely produce the best results for most businesses as will bunching. Myers CPA CFP CPAPFS MTax AEP Director of Financial Planning. Maximizing retirement contributions is a key strategy in year-end-planning meetings by setting paying the right amount of wages and balancing the net business income that flows thru to a clients personal tax return.

For Registered Education Savings Plans RESPs the maximum cumulative.

Business Year End Tax Planning In A Tcja World Kraftcpas

Six Small Business Year End Tax Planning Moves To Make Now Hourly Inc

2020 Year End Tax Planning Tips For Businesses And Individuals

Proactive Year End Tax Planning For 2022 And Beyond Mchenry Area Chamber Of Commerce

Year End Tax Planning For Individuals And Businesses The Cpa Journal

Small Business Tax Advice Tips Robert Hall Associates Tax Blog

Webinar Year End Tax Planning For Businesses

Year End Tax Planning For Small Business Owners

Using Technology To Assist With Year End Tax Planning

Proactive Year End Tax Planning For 2020 And Beyond Financial 1 Tax

Miles Financial Management Inc A Professional Tax And Accounting Firm In Exton Pennsylvania Year End Tax Planning

Year End Tax Tips Must Complete By December 31st Mark J Kohler

Year End Tax Planning Moves For Small Businesses Rbt Cpas Llp

2020 Year End Tax Planning Guide Rkl Llp

The Ultimate Year End Tax Planning Checklist Transport Topics

Three Critical Year End Tax Planning Moves

Year End Tax Planning Checklist

7 Year End Tax Planning Strategies 2020 Articles Resources Cla Cliftonlarsonallen